This page is intended to provide a broad and simplified overview of RSU-based compensation. Final details and terms vary from company to company, but the below is broadly applicable to the RSU-based compensation for the large data center operators such as Meta, Google, Amazon, and Microsoft. Consult with a qualified tax, financial or legal advisor for personal tax, financial or legal advice.

WHAT ARE RESTRICTED STOCK UNITS (RSUs)?

A restricted stock unit (“RSU”) is the right to receive a full share of your company’s stock once the applicable vesting condition is met. In other words, each RSU converts into one share of stock after the RSU is earned (i.e., the RSU “vests”).

HOW IS THE NUMBER OF RSUs DETERMINED?

You contract will usually grant you a number of RSUs equal to (A) the dollar value of RSUs specified in your offer letter, divided by (B) the then-applicable conversion price determined by the company, which is almost always the closing price of your company’s shares in the public market on the date of grant, rounded up to the nearest share. For example, if the specified dollar value of your RSU grant is $1,000 and your company’s closing price on the date of grant was $15 per share, you would be granted 67 RSUs.

WHAT ARE THE APPLICABLE VESTING CONDITIONS?

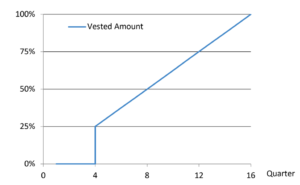

Generally, your company RSUs will vest once you meet certain continued service requirements (in other words, you’ve worked at your company for a specified period of time). The service requirement for new-hire RSUs is typically met over 4 years although this can vary pretty significantly company-to-company. The typical vesting schedule looks something like this:

(a) the requirement is met as to the first 25% of your RSUs on the applicable quarterly vesting date on or following your first anniversary with your company (described in more detail under “When Do I Receive Shares of Stock” below); and

(b) the requirement is met as to 1/16th of your RSUs each quarter thereafter over the next three years of service. For a visual representation of the vesting condition relating to service, please see the graph below:

WHEN DO I RECEIVE MY RSUs?

Your company will only grant your RSUs after you begin service at your company. On that grant date, the RSUs become legally effective and formally awarded to you. For purposes of meeting the service requirement vesting condition (described above), your service requirement vesting “cliff” (to meet the employment requirement for the first 25% of your RSU grant) will be met if your service within the your company continues through the applicable quarterly vesting date on or following the one-year anniversary of your employment start date with us. This means you don’t get your grant on the anniversary date, the company only gives grants once per quarter to all eligible employees!

WHEN DO I RECEIVE SHARES OF STOCK?

RSUs convert into shares of your company’s stock on the relevant quarterly vesting date, after the applicable vesting condition is met. You don’t have to pay a purchase or exercise price or take action with regard to your RSUs to turn your vested RSUs into shares. As is standard practice among public companies, for legal and administrative purposes, vesting of your company RSUs occurs on certain quarterly vesting dates (generally, February 20th, May 20th, August 20th, and November 20th each year). If, as a hypothetical example, your first day of employment at your company was November 1, 2024, 25% of your new-hire RSUs would be scheduled to vest on November 20, 2025 and then the remainder over your next three years of service, with 1/16ths of the RSUs vesting on February 20, 2026 and on each quarterly vesting date afterward, in each case, if you continue employment with us through the applicable vesting date.

HOW MUCH ARE RSUs WORTH?

RSUs have intrinsic value in the sense that, following vesting, each RSU represents the value of one full share of stock. In other words, because RSUs do not have a purchase price, the value of an RSU always corresponds to your company’s actual share price, at the time of vesting. After your RSUs have vested and you’ve received your company shares, as an owner of shares in a public company, you may sell them in the public market on a public stock exchange, subject to any applicable legal and regulatory requirements, insider trading policies, applicable settlement periods, and the terms of the relevant equity plan and agreements. However, as stock prices fluctuate, your potential return will only be realized after your RSUs have vested and you sell the underlying shares at the applicable market price at the time of sale.

HOW AND WHEN ARE RSUs GENERALLY TAXED?

Generally, no taxes are owed on RSUs until they vest and you receive shares of stock. At vesting, you will typically be liable to pay in the applicable country (presumably the United States if you’re reading this) where you worked during the vesting period, income tax and, potentially, social security or other applicable contributions on the value of the shares you receive. Depending on the country concerned, some or all of this liability may need to be withheld by your employer or may need to be paid directly to the IRS/state tax authorities. In any event, upon vesting, you will be able to sell shares to realize sufficient proceeds to cover these tax liabilities (subject to any applicable legal and regulatory requirements, insider trading policies, and the terms of the relevant equity plan and agreements) – most companies do not expect that you will have to pay these liabilities “out of pocket” at the time of vesting. Generally, the default provisions in RSU agreements will automatically provide for the sale of enough shares to cover any tax withholding obligations. However, as mentioned below, you may ultimately owe more or less in taxes than your new company is required to withhold. If you do not immediately sell all of the shares of stock you receive after your RSUs vest, when you ultimately dispose of those shares you may incur additional tax liability on any future gain you receive above the share price that applied at vesting. For example, in the United States, any gain or loss you recognize upon the sale or exchange of shares that you held for future sale after your RSUs vested will generally be treated as a capital gain or loss and will be long-term or short-term, depending upon whether you held the shares for more than 1 year after the RSUs vested. Further, any amounts withheld to cover applicable tax withholdings at the time of vesting of any RSUs may result in under- or over-withholdings, depending on your personal tax situation, meaning you will likely either need to “true up” the taxes you owe or be refunded for any excess tax paid, as applicable. The specific way your RSUs will be taxed is dependent on the circumstances of your personal tax situation (including state/local tax laws).

This basic explanation is generally applicable, you should speak to your personal tax advisor in connection with your award and the tax consequences of vesting, selling shares, and other related activities.